Enrolled Agent (EA)

What is an Enrolled Agent (EA)?

Enrolled Agents (EAs) are federally-licensed tax practitioners who may represent taxpayers before the IRS when it comes to collections, audits and appeals. As authorized by the Department of Treasury's Circular 230 regulations, EAs are granted unlimited practice rights to represent taxpayers before IRS and are authorized to advise, represent, and prepare tax returns for individuals, partnerships, corporations, estates, trusts, and any entities with tax-reporting requirements. Enrolled agents are the only federally-licensed tax practitioners who specialize in taxation and have unlimited rights to represent taxpayers before the IRS.

An Enrolled Agent Course is highly valued in the industry as it is backed by the IRS (Internal Revenue Service).

Furthermore, an Enrolled Agent’s salary is, on an average, nearly 17% higher compared to non-qualified preparers.

Advantages of EA over other courses in India:

|

Particulars |

EA |

PROF.COURSES |

|

No. of Subjects / Papers |

3 Papers |

16 Papers |

|

Course duration |

3-6 months |

3-6 years |

|

Exam pattern |

MCQ |

Theory |

|

Pass Percentage % |

69% |

8-10% |

|

Certification value |

Highest tax qualification offered by the IRS |

Professional qualification in India |

|

Course cost |

INR 1.5 Lacs |

INR 3 Lacs |

|

Career opportunities abroad |

High |

Low |

|

Starting salary |

INR 4-7 Lacs |

INR 4-7 Lacs |

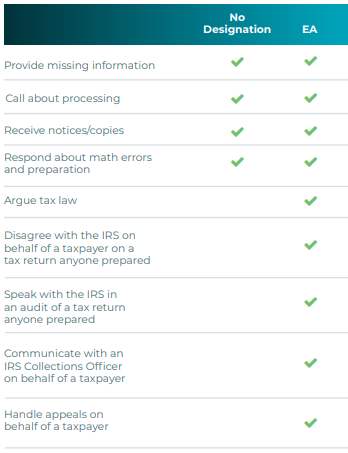

This excerpt from a chart produced by the National Association of Tax Professionals (NATP) breaks down the rights the candidates have after becoming an EA:

For further details please visit the official website of the United States Government

https://www.irs.gov/tax-professionals/enrolled-agents/enrolled-agents-frequently-asked-questions